Crypto expert Crypto Eri raises concerns over CME’s upcoming XRP futures contract, which will be cash-settled in USD. Discover the impact on XRP’s liquidity, institutional interest, and ETF prospects.

Concerns Rise Over CME Group’s Cash-Settled XRP Futures as Institutional Interest Grows

The announcement of XRP futures contracts launching on the Chicago Mercantile Exchange (CME) has created a wave of enthusiasm across the crypto space, especially among XRP supporters. Set to debut on May 19, these contracts mark a significant milestone for institutional-grade exposure to the fourth-largest cryptocurrency by market capitalization. However, the excitement has not come without its share of scrutiny. Prominent XRP community voice and crypto analyst, Crypto Eri, has sounded the alarm over one critical detail in the structure of the upcoming CME XRP futures contracts: the method of settlement.

Cash-Settled Contracts: A Missed Opportunity?

Unlike what many XRP enthusiasts hoped for, the CME’s XRP futures will not be settled in the actual cryptocurrency. Instead, they will be cash-settled in US dollars. This means that traders will never actually take possession of XRP at any point during the trade lifecycle—from entering the position to final settlement. All transactions are purely conducted in fiat, effectively disconnecting the futures market from the physical XRP asset.

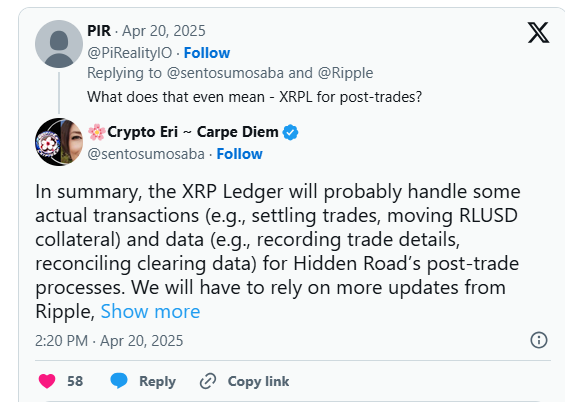

Crypto Eri emphasized that such a structure eliminates any real interaction with XRP, thereby failing to drive direct demand or liquidity for the token. For example, participants won’t need to deposit or withdraw XRP into brokerage accounts, removing the pressure on exchanges and custodians to handle the asset. As a result, the derivative market remains largely isolated from the real crypto economy of XRP, which could otherwise benefit from increased trading volume, real demand, and more dynamic price movements.

Comparison With Other Crypto Futures Markets

Supporters of the CME’s approach argue that this is not unusual. Crypto analyst Mickle pointed out that similar settlement models are already in place for Bitcoin futures on CME, suggesting that this practice is standard across major derivatives exchanges. In essence, the choice of cash settlement provides a regulated, risk-controlled environment that appeals to institutional investors who may be hesitant about handling the actual crypto asset.

Nevertheless, Eri contends that this model may not serve the best interests of XRP’s ecosystem in the long term. She advocates for physically settled contracts that could drive real demand for XRP by requiring the actual asset to change hands upon contract expiration. According to her, such contracts would provide a more organic price discovery mechanism and enhance market liquidity.

Bitnomial and Coinbase Present Alternatives

While CME’s move brings XRP into the spotlight on a major U.S. derivatives exchange, it’s not the only institutional-level player in the game. Bitnomial already offers XRP futures that are physically settled—meaning the buyer receives XRP at the end of the contract. Coinbase, on the other hand, recently introduced its own XRP derivatives product, which, like CME’s, is cash-settled in USD.

These developments reveal the growing interest of institutions in XRP, though the nature of these products varies in their potential impact on the asset’s market dynamics. Physical settlement adds a layer of utility and demand to XRP, while cash settlement simply allows investors to speculate on price movements without affecting on-chain liquidity.

The Regulatory Outlook and ETF Prospects

The mere fact that the Commodity Futures Trading Commission (CFTC) approved CME’s XRP contracts suggests a softening stance on XRP’s regulatory status in the U.S. This approval could signal that XRP is gaining clearer regulatory standing, encouraging more institutions to consider exposure.

With multiple firms such as Grayscale, Bitwise, and Canary Capital reportedly eyeing XRP spot ETFs, the stage could be set for another major development. The presence of pro-crypto figures like Paul Atkins within regulatory bodies adds a layer of optimism that an XRP ETF might be just around the corner. If such products gain approval, they could open the floodgates to a broader range of institutional and retail investors.

FAQs

1. What is the CME XRP futures contract?

The CME XRP futures contract is a derivatives product that allows investors to speculate on the price of XRP without directly owning it. It is set to launch on May 19 and will be cash-settled in USD.

2. Why is the cash settlement of XRP futures a concern?

Cash settlement means that traders never actually buy or sell XRP, which limits the potential impact on the token’s price and on-chain liquidity. Some believe this approach reduces XRP’s market utility.

3. Are there any physically settled XRP futures available?

Yes, Bitnomial currently offers XRP futures contracts that are physically settled, meaning XRP is delivered to the buyer upon contract expiration. These contracts directly influence XRP’s liquidity and market demand.

4. How does this relate to potential XRP ETFs?

The approval of XRP futures by the CFTC may pave the way for XRP spot ETFs, as it indicates growing regulatory clarity. Several firms are currently pursuing ETF approvals with the SEC.

5. What impact could physically settled contracts have on XRP?

Physically settled futures could increase demand for XRP, improve liquidity, and help in more accurate price discovery. This would benefit the ecosystem by tying futures market activity to real-world usage.