Discover how one user turned $15 into a potential $700,000 by investing in Dogecoin, only to lose it all. A cautionary tale of crypto’s volatility.

The Risky Nature of Cryptocurrency Investment

The cryptocurrency market is a wild and unpredictable space, where fortunes can change in the blink of an eye. Stories of staggering profits and heartbreaking losses are common in the crypto world, where volatility is the name of the game. For every person who hits it big, there’s another who loses everything. One such tale, involving an early Dogecoin investor, highlights the extremes of these ups and downs and serves as a cautionary tale for anyone looking to venture into the market.

Dogecoin’s Rise from Meme Coin to Market Powerhouse

Dogecoin was originally launched as a joke, designed to poke fun at the growing trend of digital currencies. With a Shiba Inu dog as its mascot, it was never expected to be taken seriously. However, over time, Dogecoin became a household name, especially after it garnered attention from social media and high-profile figures like Elon Musk. What began as a meme currency has since skyrocketed in value, making early investors incredibly wealthy.

One user, who goes by the name “Simulated Fleshnamics” on Twitter, shared a story of how a small investment in Dogecoin turned into an almost unimaginable fortune—only to slip through his fingers. This story serves as a stark reminder of both the potential rewards and the significant risks of crypto investing.

A $15 Gamble That Could Have Made $700,000

In 2015, a user took a gamble with just $15, purchasing 1 million DOGE at the price of $0.000015 per coin. At the time, Dogecoin was still struggling to gain traction, with little expectation of it turning into anything of substantial value. Little did the investor know, this seemingly insignificant $15 purchase would become a missed opportunity worth hundreds of thousands of dollars.

As the years passed, Dogecoin’s price gradually increased, but it wasn’t until 2018 that the price saw a significant rise. By January of that year, Dogecoin had reached $0.0186 per coin, a modest increase but still far from its eventual meteoric rise. However, the true surge came in 2021 when Dogecoin hit an all-time high of $0.7488.

Had “Simulated Fleshnamics” held on to his 1 million DOGE until then, his $15 investment would have swelled to a staggering $700,000—an astronomical 4,666,566% return on investment.

The Price Drop and the Missed Gains

Despite missing out on the high of 2021, Dogecoin remains a lucrative asset, albeit significantly lower than its peak. As of now, Dogecoin’s price hovers around $0.1567, which means that the 1 million DOGE originally purchased for $15 would still be worth an impressive $156,700. That’s still an eye-popping 1,044,566% increase over the initial investment. While far from the $700,000 it could have been, it’s still a massive gain that highlights the importance of holding on to your investments in a volatile market.

The story of “Simulated Fleshnamics” is not unique. It’s a reflection of the volatile nature of cryptocurrency and how timing plays a huge role in determining an investor’s success or failure. Had he held on to his coins just a little longer, the story would have been a much happier one.

The Highs and Lows of Holding Cryptocurrencies

The rise and fall of Dogecoin also highlights one of the most challenging aspects of cryptocurrency investment: its extreme volatility. While the potential for massive returns is undeniably appealing, the rapid fluctuations in price can also cause significant losses. For those who managed to hold on during the wild ride, the rewards were astronomical. For others, like “Simulated Fleshnamics,” the story was one of lost opportunities and what-ifs.

Crypto investors often face the emotional challenge of knowing when to buy and when to sell. With such significant volatility, it’s easy to second-guess decisions, especially after missing out on huge gains or, conversely, losing substantial amounts. The key takeaway from stories like these is that patience and timing are critical factors in navigating the crypto market.

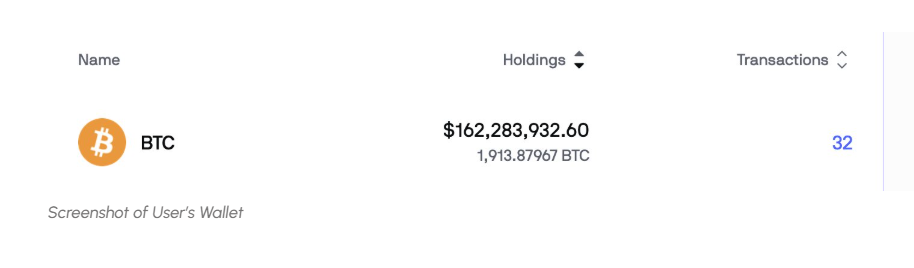

A Parallel Story: The Bitcoin Whale Who Lost His Seed Phrase

“Simulated Fleshnamics” isn’t the only one to miss out on a potentially life-changing investment. Another story that surfaced recently involves an early Bitcoin investor, Griffin McShane, who lost access to a fortune worth $163 million. McShane had purchased Bitcoin in 2015, accumulating 1,914 BTC. At the time, Bitcoin was relatively inexpensive, and McShane’s investment seemed like a wise choice.

However, as Bitcoin’s price skyrocketed over the years, McShane’s small investment grew into a multi-million-dollar fortune. Unfortunately, McShane lost his seed phrase, making his Bitcoin wallet and its contents completely inaccessible. This situation highlights one of the biggest risks of cryptocurrency investing: the responsibility that comes with managing your private keys and wallet access.

The Unforgiving Nature of Blockchain Technology

The case of McShane underscores another critical issue with blockchain-based assets—security and access. While the blockchain offers a decentralized and secure method of transferring and storing digital assets, it also means that if users lose their access credentials, there’s no way to recover them. There are no customer support hotlines, no bank systems to reverse mistakes, and no central authority to offer help. This decentralized nature, while advantageous in many ways, also comes with significant risks for users who fail to manage their wallets properly.

The tragedy of lost seed phrases is not an isolated incident. In fact, millions of dollars’ worth of Bitcoin, Ethereum, and other cryptocurrencies are essentially locked away and inaccessible due to lost or forgotten access credentials. This highlights the need for responsible management of digital assets in the cryptocurrency space.

The Profitability of Holding Crypto Long-Term

Despite these challenges, both the Dogecoin and Bitcoin stories illustrate one undeniable truth about cryptocurrency: patience can yield enormous rewards. While the market is undoubtedly volatile, it has created immense wealth for those who were able to hold on through the fluctuations. In the case of Dogecoin, early investors who bought in at the right time have reaped substantial profits. For those who are willing to take on the risks, the potential rewards are there, but it requires a long-term perspective.

The Takeaway: Don’t Let Emotion Drive Your Decisions

For new investors, the takeaway from these stories is clear: the cryptocurrency market can be incredibly rewarding, but it also requires a level of discipline, patience, and careful planning. It’s easy to get caught up in the excitement of a rapidly rising market, but making decisions based on emotion can lead to missed opportunities or significant losses. Holding on to assets through periods of volatility, and making thoughtful decisions based on solid research rather than impulse, is essential for long-term success in the crypto market.

FAQs

1. How much would my $15 investment in Dogecoin be worth today?

Your $15 investment in Dogecoin could be worth around $156,700 today if you had held onto 1 million DOGE from 2015, reflecting a 1,044,566% return.

2. Why is cryptocurrency so volatile?

Cryptocurrency is highly volatile because it is still a relatively young market with low liquidity and heavy speculation. Prices can be influenced by news, market sentiment, and global events.

3. How can I protect my crypto investment from being lost?

To protect your crypto investment, ensure that you keep your private keys and wallet access credentials safe. Use secure hardware wallets, and consider backing up your seed phrase in multiple, secure locations.

4. Should I buy Dogecoin now?

The decision to invest in Dogecoin depends on your risk tolerance and investment goals. It’s essential to conduct thorough research and understand the risks involved before making any investment.

5. What can I learn from these crypto investment stories?

These stories emphasize the importance of timing, patience, and careful management of your investments. Understanding the risks, being disciplined, and holding assets through volatility can lead to long-term rewards.