XRP options show a bearish skew despite rising liquidity and ETF optimism. Traders stay cautious ahead of key regulatory decisions.

XRP Options Market Shows Bearish Skew Amid Bullish News

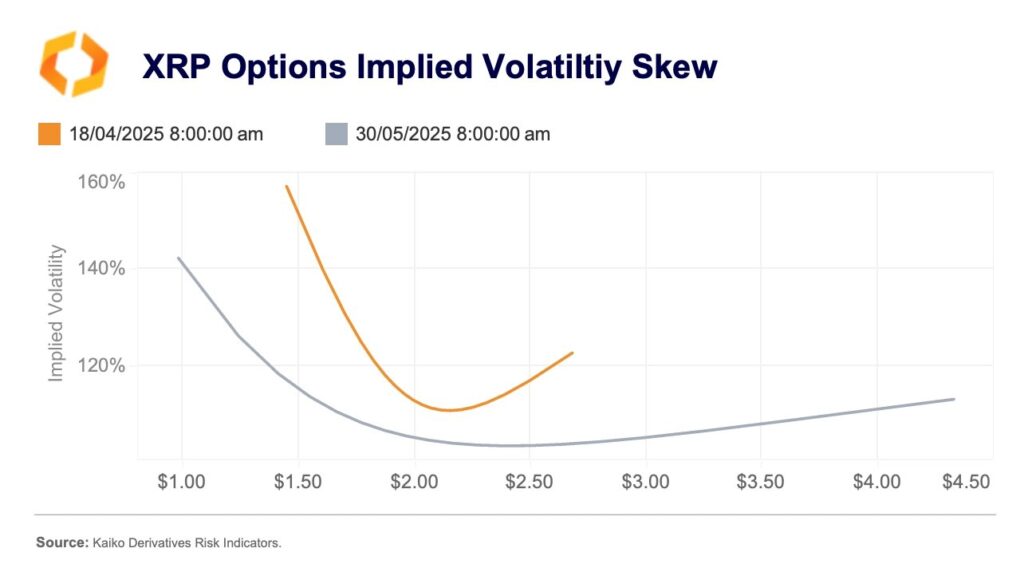

The XRP options market is currently showing signs of bearish sentiment, even as the broader environment surrounding the cryptocurrency is filled with positive developments. According to options data from Deribit, shared by blockchain analytics firm Kaiko, the implied volatility (IV) smile for XRP options expiring on April 18 is sharply tilted to the downside. This technical pattern suggests that traders are seeking protection against potential short-term losses, especially by buying out-of-the-money (OTM) puts.

In practical terms, this behavior is driven by demand for options that provide downside insurance. Notably, options traders are targeting strike prices around $1.5, where implied volatility reaches as high as 160%—a significant indicator of hedging pressure. This skewed IV curve implies that traders expect potential price drops in the near term and are paying a premium to safeguard their positions.

Interestingly, options with later expirations such as May 30 show a far more balanced volatility curve, hinting that the bearish sentiment is short-term in nature. This divergence suggests that investors are reacting to specific upcoming events rather than taking a fundamentally negative view on XRP’s long-term trajectory.

Upcoming SEC Decision on XRP ETF Weighs Heavily on Traders’ Minds

A major source of market anxiety is the U.S. Securities and Exchange Commission’s (SEC) pending decision on Grayscale’s application for a spot XRP exchange-traded fund (ETF). The deadline for this decision is set for May 22, just weeks after the April options contracts expire. This timeline creates a narrow window of uncertainty, prompting traders to adopt a defensive posture in case of unfavorable regulatory outcomes.

Despite recent developments that would suggest a more positive stance from the SEC, market participants remain cautious. For instance, Teucrium, an ETF issuer, recently launched a 2x leveraged XRP ETF—a financial product widely considered riskier than a standard spot ETF. Analysts argue that if the SEC is willing to approve such a high-risk product, it will face both legal and reputational pressure to also approve a less volatile spot ETF.

This reasoning finds support in the SEC’s handling of Bitcoin ETF approvals. In 2023, the regulatory body was compelled to greenlight Bitcoin spot ETFs after previously allowing futures-based ETFs that mirrored spot prices with over 99% correlation. This contradiction became a legal vulnerability for the SEC, especially following Grayscale’s successful court challenge. XRP supporters hope a similar legal logic will lead to favorable ETF treatment.

However, unlike Bitcoin, XRP lacks a robust U.S. futures market. Much of its trading activity still occurs on international platforms. That said, XRP’s U.S. exchange presence has recovered significantly. Since the SEC’s 2020 lawsuit against Ripple Labs led to mass delistings, the token’s share on U.S. spot exchanges has rebounded to its highest levels in years, a positive signal that cannot be overlooked.

XRP Gains Ground While Competitors Like Solana Lose U.S. Market Share

Another point supporting XRP’s rising credibility is its comparative strength against other major altcoins in the U.S. market. For example, Solana, which once enjoyed a solid U.S. exchange presence, has seen a steady drop in market share. From holding 25–30% of U.S. altcoin trades in 2022, Solana has now fallen to just 16%. In contrast, XRP has reclaimed lost ground and continues to climb in both market presence and depth.

This trend underscores a larger shift in how institutional and retail traders are positioning themselves. While Solana’s decline may be attributed to various factors such as network outages and regulatory ambiguity, XRP’s resurgence is bolstered by increased liquidity, legal clarity from Ripple’s partial legal victories, and optimism around a potential ETF approval.

These contrasting trajectories point to a reallocation of investor interest, as confidence in XRP’s regulatory outlook and trading infrastructure grows.

XRP’s Market Fundamentals Strengthen Significantly

Beyond speculation and options market behavior, XRP’s underlying market fundamentals paint an increasingly bullish picture. The token now leads all altcoins in U.S. spot market depth, surpassing even high-profile competitors like Cardano and Solana. Market depth is a critical metric that reflects the ability to handle large trades without significant price slippage—a key requirement for institutional traders.

Liquidity has also surged, further supporting the argument that XRP is becoming one of the most structurally sound altcoins in the market. With broader adoption and improved trading conditions, XRP is no longer seen as a speculative asset but rather a viable contender for mainstream financial instruments like ETFs and institutional trading desks.

Moreover, these improvements come at a time of regulatory transition in the U.S.. Following Gary Gensler’s departure from the SEC, Paul Atkins has taken over as interim Chair. Atkins is known for his market-friendly stance and is considered more open to cryptocurrency innovation. This leadership change could significantly influence the outcome of future ETF applications, including that of XRP.

XRP ETF Approval Could Transform Market Sentiment

Approval of a spot XRP ETF would mark a pivotal moment for the asset. Such a development would not only provide legal validation but also open the floodgates for institutional capital inflows. Spot ETFs allow investors to gain exposure to digital assets without the need to manage wallets or deal with exchange risk. They also bring improved transparency, liquidity, and accessibility.

Should the SEC approve the Grayscale XRP ETF application—or even provide positive signals toward future approval—it would likely ignite a new wave of interest in XRP, possibly leading to rapid price appreciation. Traders currently hedging against downside risk might find themselves repositioning quickly in a bullish direction.

Until then, cautious optimism prevails. While the XRP options market reflects short-term unease, the longer-term outlook remains hopeful, bolstered by a changing regulatory landscape and solidifying market fundamentals.

FAQs

1. Why is the XRP options market showing a bearish skew?

Traders are hedging short-term risks related to the SEC’s upcoming ETF decision. This has led to increased demand for downside protection via out-of-the-money put options.

2. What impact could a spot XRP ETF have on the market?

Approval would likely attract institutional investors, increase liquidity, and significantly boost XRP’s price by providing mainstream exposure.

3. How is XRP performing compared to other altcoins like Solana?

XRP is gaining U.S. market share and liquidity, while Solana’s presence is shrinking. This reflects a broader shift in investor confidence toward XRP.

4. Does the change in SEC leadership affect XRP’s prospects?

Yes. With Paul Atkins taking over from Gary Gensler, the SEC may adopt a more crypto-friendly approach, which could positively influence ETF decisions.

5. Is XRP a good long-term investment right now?

While short-term volatility exists, improving fundamentals, regulatory clarity, and ETF potential make XRP increasingly attractive for long-term investors.